Sears continues to lose money

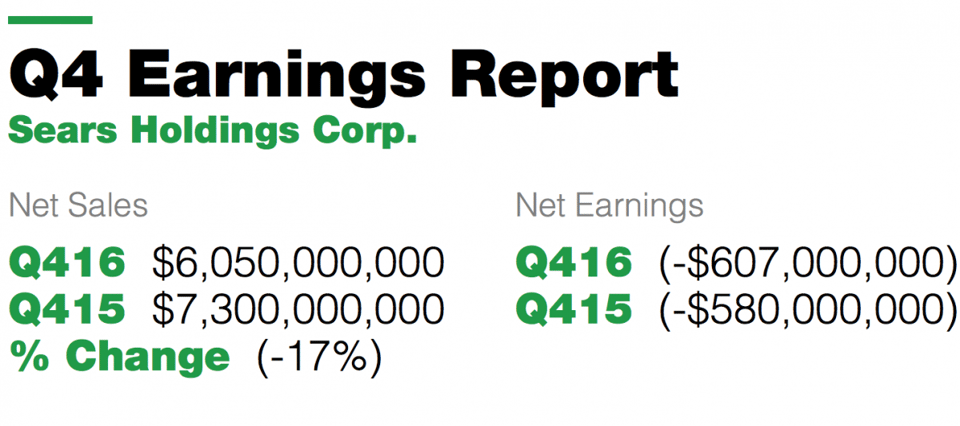

Sears Holdings Corp. sales plunged 17% to $6.05 billion in the quarter ended Jan. 28, down from $7.3 billion a year earlier. Although the chain’s reduced store portfolio contributed to the decline, same-store sales fell 10.3%, driven by an 8% drop at Kmart and a 12.3% at Sears.

Sears lost a less-than-expected $607 million, compared with $580 million in the year-ago period. However, the adjusted loss, which factored in one-time gains and costs, was $1.28 per share, compared to $1.70 a year earlier, amid lower payroll, inventory and marketing costs.

“Sears has ended its fiscal year with a set of results that can only be described as dire,” said analyst Neil Saunders, managing director of GlobalData Retail. “Not only are sales down, but the pace of decline has accelerated sharply. At total level, some of this is the result of store closures across the year – something we believe is sensible and prudent in light of changing patterns of demand. However, much of the dip is also attributable to a slump in the number of shoppers visiting Sears and Kmart, and a continued deterioration in conversion rates among those that do. The blunt truth is that Sears is simply not delivering what consumers want.”

Although Sears has been selling assets, including the recent sale of its Craftsman brand, to raise cash, its long-term debt obligations continued to increase, nearly doubled, increasing to $4.2 billion from $2.2 billion in the year-ago period. (On Thursday, Sears announced it completed the sale of its Craftsman brand to Stanley Black & Decker for an initial cash payment of $525 million, with additional payouts over time.)

The retailer’s merchandise inventories declined to $4 billion, from $5.2 billion a year earlier. Total costs and expenses fell to $6.77 billion, from $7.84 billion.

“While the challenging holiday selling season pressured margins and comparable store sales, we were able to successfully improve profitability through disciplined inventory and costs management,” stated Jason M. Hollar, CFO, Sears Holdings. “We will continue to take actions to drive profitability, generate liquidity and adjust our overall capital structure while continuing to meet all of our financial obligations."

For the full year, revenues totaled $22.1 billion to revenues of $25.1 billion in the prior year. The decline included a decrease of $1.3 billion as a result of having fewer Kmart and Sears Full-line stores in operation.

For the full year, comparable store sales declined 7.4%, which contributed to $1.4 billion of the revenue decline relative to the prior year.