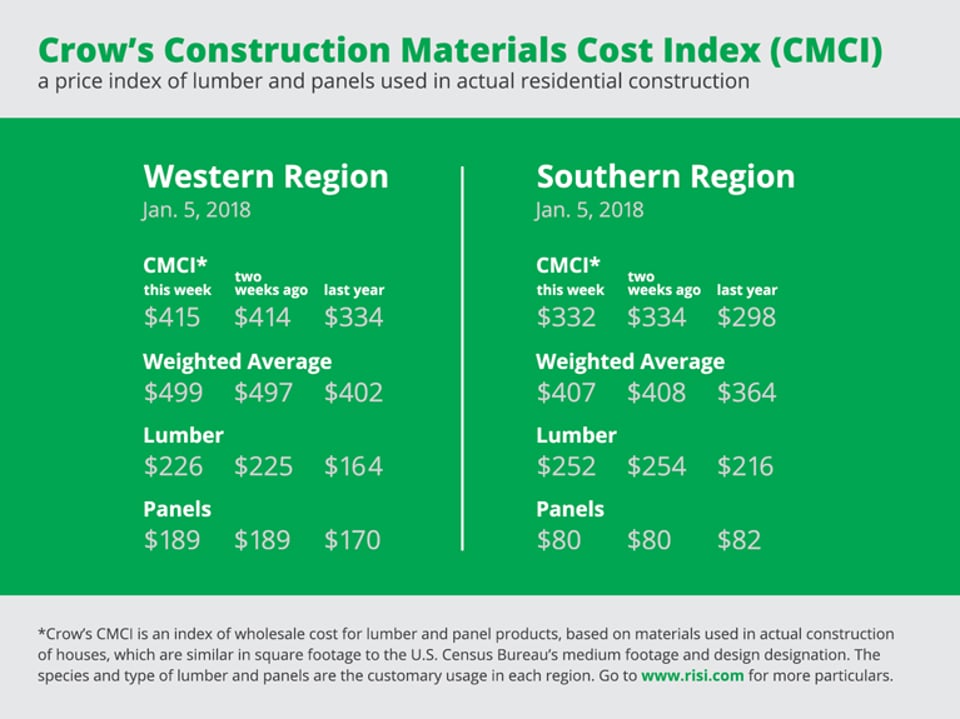

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for Jan. 5, 2018.

Western: regional species perimeter foundation

Southern: regional species slab construction

Crow's Market Recap: A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber

SPF traders often expressed some degree of surprise regarding the level of market activity, especially considering the extreme weather conditions throughout much of the US and Canada. Good sales activity led to several price increases at mills in both eastern and western Canada.

Freezing conditions extending deep into the Southeast created numerous issues for Southern Pine producers and distribution. Mills reported sporadic or curtailed production. Ice and snow delayed shipments out of yards and shut down job site activity, especially along the East Coast late in the week.

Coastal species sold in good volumes, but prices were mixed across the spectrum of #2&Btr items. Wide widths were more prone to discounts than narrows. Meanwhile, green Doug Fir maintained a stronger position than its dry counterparts. The same major driver remained in play – strong sales into California.

Inland producers reported some strengthening of prices. That strength did not include significant price appreciation, but both the pace of buying and buyer attitudes improved.

While 8-foot stud pricing often held close to prior levels, good demand for 9-foot propelled those prices higher in many instances. Mills in eastern Canada reported “strong” 9-foot and 10-foot SPF sales in both 2x4 and 2x6 trims. Supplies of those items were particularly tight.

Radiata Pine 6/4 lumber remained flat in all reports, but 5/4 Shop moved up $10, based on sellers attempting to infuse some energy into prices.

Ponderosa Pine Mldg&Btr and Shop were reported to be strong, with 5/4 Shop showing another $10 to $15 gain in selling levels.

After transporting significant volumes of Western Red Cedar over the border prior to last week’s initiation of duties, mills sold fair volumes from those inventories. Severe weather throughout much of the eastern half of the US limited consumption, but yards often checked on orders to make sure shipments were on time.

Panels

OSB markets were quiet but firm this week post-holiday, with many participants still away from their desks. Brutally cold weather in the east hampered sales, but inventories are lean and order files out two to three weeks in most regions.

While frigid temperatures, snow and ice in the East negatively affected the week’s rate of Southern Pine plywood consumption, mill sales were often described as “real good.” Producers managed to keep order files comfortably out in front of them and bumped several prices moderately higher.

Lead times at Western Fir plywood mills extended into the week of Jan. 15, with some volumes sold into the following week. In addition, producers tested higher quotes, and by the end of the week, managed to successfully sell at slightly higher levels.

Canadian plywood markets entered the new year on a quiet but strong note after a bit of a run going into the holidays. Although cold weather slowed activity this week, producers and buyers call the market strong based on long order files.

Particleboard and MDF sales got off to a decent start in 2018. Most producers expected a modest beginning to the year with hopes of activity picking up sometime in the first few months.

For more on RISI, click here.