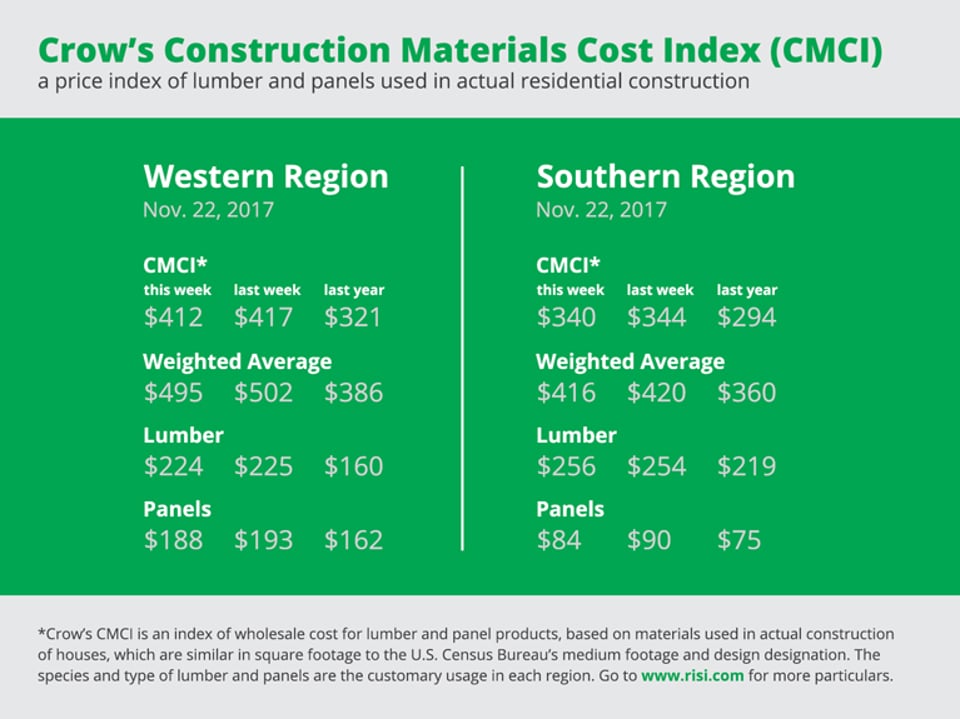

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for Nov. 17, 2017.

Western: regional species perimeter foundation

Southern: regional species slab construction

Crow's Market Recap: A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber

SPF sales slowed, eroding some order files while other mills reported selling a little more than a week’s production. Despite the lackluster pace, western mills sold at higher price levels. Eastern dimension prices were flat to up modestly.

Typical seasonal influences held back Southern Pine sales, but activity was solid. Yards regulated inventories closely, balancing purchases with sales. Producers continued to hear from buyers looking for an alternative to high priced and thinly supplied SPF.

Most Coastal species lumber prices held at prior levels or dropped moderately. Those most influenced by SPF pricing and supplies remained firm. Mills noted good liquidity across most reported items despite a cautious approach from buyers.

Inland lumber demand was reported to be strong; most producers noted order files reaching at least a week further out than usual. Prices for #2&Btr were solid, with the exception of Hem-Fir 2x8, which ranged fairly widely among producers.

Stud demand diminished, prompting traders to perceive a ceiling on some price levels established in the current cycle. Traders expressed the opinion that trading during Thanksgiving week would likely slow further.

Prices were reported to be unchanged for Radiata Pine industrials.

Ponderosa Pine industrial lumber supplies were reported to be tight, causing buyers some concerns. Most major users were able to fill their needs by taking smaller volumes in shorter buying cycles, finding it difficult to source material in their usual volumes. In boards, millwork plants searched hard for Ponderosa Pine Commons, especially #3 and #4 Commons. Finding it in sufficient volumes was reported to be difficult.

Among other 4/4 boards, changes of note were reported in ESLP Commons.

Market activity in Western Red Cedar continued to resemble what usually occurs in November as the Thanksgiving holiday approaches. Buyers filled in inventories with mixed truckload and carload volumes.

Panels

The question surrounding OSB markets involves whether or not stabilization is near. Again, prices fell hard this week, leaving buyers unwilling to own any more panel than needed. The pipeline needs wood; however, and buyers are chasing orders, wondering when loads will arrive.

Southern Pine rated sheathing prices continued to peel back as producers lowered quotes to keep some distance between lead times and production. Rated sheathing order files ranged from the week of November 20 out to Dec. 4.

Downward price pressure persisted in Western Fir plywood. Buyers received numerous phone calls from mills looking to sell quick shipping volumes. Deeper discounts did entice buyers to purchase more volume while other producers chose to “grind it out” by limiting the depth of price cuts.

Very little changed in the Canadian plywood market this week, as it maintained its strength and stability. Activity was steady, albeit mellow, through most provinces. The emphasis for producers centered on moving order file. Pricing is sideways from last week.

Producers of particleboard and MDF experienced much of the same kind of week they have over the past month. Some reported being a bit busier, as customers tried to check off their lists prior to the holiday week. Prices for both MDF and particleboard held.

For more on RISI, click here.