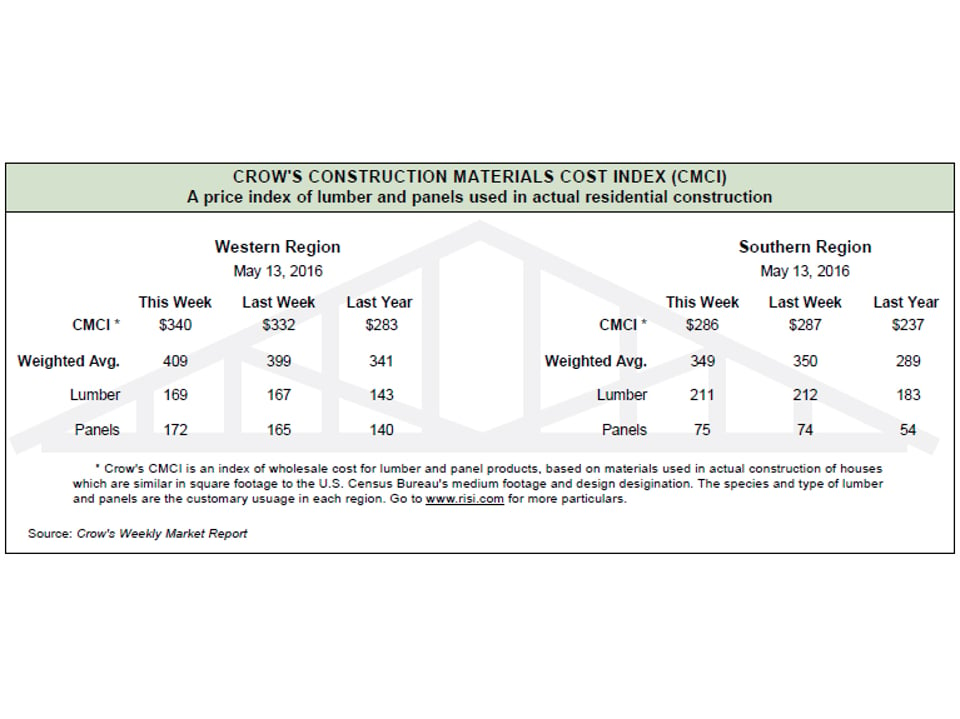

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for May 6, 2016

*Western - regional species perimeter foundation; Southern - regional species slab construction.

Crow's Market Recap -- A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber: SPF lumber sales slowed considerably from the week prior’s onslaught. Producers did manage to bump some prices higher Friday the week prior and early this week in response to extended order files, particularly in 2x4. Those lead times ranged from two weeks out to the week of May 23. Because of the slower pace in the Southern Pine market, many prices flattened and some trading occurred a few dollars both above and below prior levels. Buyers wary of the lofty levels some of those prices have attained, held off purchases whenever possible. Traders often found the Coastal species market a bit confusing, as producers often “did their own thing” with regard to sales levels. Mills approached the market with lower priced volumes of varying items at different intervals, which helped generate some uncertainty among buyers. Green Doug Fir prices gained some traction. Inland dimensional lumber has been a mixed situation, largely dependent on the species involved. Softness continues to dominate both Fir-Larch and Hem-Fir narrows. After a strong week of sales the week prior, stud producers entered the market this week with order files and thus a greater overall ability to continue raising prices. Changes in Radiata Pine have been negligible this session. Ponderosa Pine continues to be a mixed bag, with all grades available. Questions surrounding the softening of Mldg&Btr focus on the fact that it is not uniformly available in quantity in all regions of the producing zone. The last two weeks have shown di stinct growth in both demand and price levels for Ponderosa Pine Common boards. ESLP #4 Commons showed significant downward shifting in all widths. Western Red Cedar sales activity remained strong and supplies were tight. Producers reported selling some tight knot items as far out as July.

Panels: OSB markets were a runaway this week, to the point that even veteran buyers were lagging by up to $25 on some of their information. Buyers were caught off side by their inventory positions, many of which were depleted or low. The Southern Pine plywood market experienced enough sales activity to allow producers to move order files out another week, or a bit more, and raise prices. Wholesalers stepped in to purchase greater volumes, while yards, reporting good sales, reentered the market. Sales activity in the Western Fir plywood market continued at a strong pace, leading to higher pricing across all sheathing items. Wholesalers questioned whether to buy back in at the end of the week, lending to the feel among producers that buyers were not chasing the market. Late Thursday, Canadian plywood buyers were paying +3 and even +4, in an attempt to keep current with the market. By Friday late morning, a full +5 had been realized. Particleboard demand in the East and South remained robust. Mill order files ranged from the last days of May out into the front half of June. Mills reported a good week of bookings in MDF.

For more on RISI, click here.