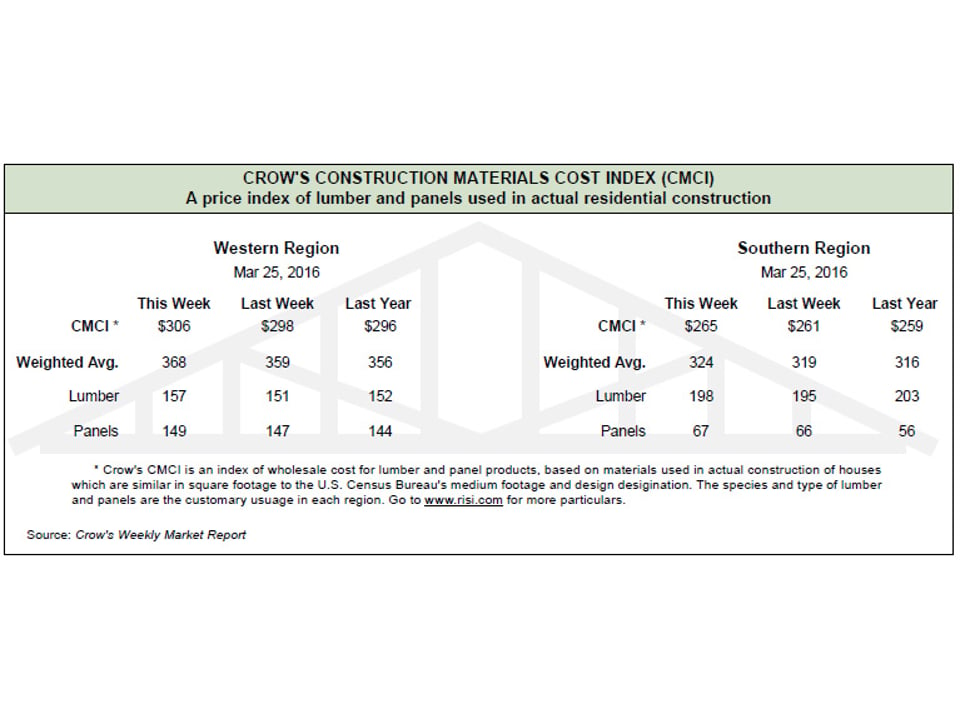

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for March 18, 2016

*Western - regional species perimeter foundation; Southern - regional species slab construction.

Crow's Market Recap -- A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber: The SPF lumber market retained a solid base, as order files stretched out into the first couple of weeks of April. Mills raised wider-width prices more aggressively in the West than in the East. Sales activity overall remained strong. Lingering effects from heavy rains in the Southeast the prior week continued to shape the Southern Pine market to some degree. While production ceased at some mills for several days, yards struggled to deliver volumes to saturated job sites. Much of the strength remained in wide widths. Price strength continued to vary by item, but most prices in the Coastal species market remained firm or increased. Green Doug Fir and Hem-Fir levels continued to move higher. Dry Doug Fir pricing was flatter. Inland lumber producers report inquiry and sales activity were sufficiently strong to keep prices firm and, in some cases, a little improved. This is especially true of Hem-Fir narrows, although Fir-Larch narrows also showed some gains. Strong sales activity and solid order files generated higher prices in stud markets. Increases overall ranged from $5 to $10 in nearly all instances. Relatively tight Western Red Cedar availability was limited even further with the Monday announcement of a mill closure. Buyers immediately scrambled to find alternate sources. In Radiata Pine, the general trend is toward continued tightness. Radiata Shop is largely a moot point, since most of it goes into alternative markets. Ponderosa Pine lumber has shown considerable stability over the last few weeks, as a result of some excesses being reduced. Countering is still the common tactic in the lower grades of Shop. Ponderosa Pine 4/4 boards continue to improve incrementally, the market tone improving as buyers become active.

Panels: OSB activity slogged through the week, sinking into what was described as a “rut” after a small run a couple of weeks ago. Pricing fell off a few dollars in most regions, or moved sideways. There is a sense that everyone bought the wood they needed and the market stalled. Southern Pine plywood producers managed to keep order files extended out to a comfortable length of time while maintaining firm pricing. In some instances, prices crept higher. Most lead times were in the week of March 28. Sales activity in the Western Fir plywood market slowed from levels that mills experienced the prior few weeks. Lead times ranged from the week of March 28, with scattered volumes available sooner, out to April 11, where a one-week maintenance shutdown extended that order file. Activity in Canadian plywood markets slowed this week from last week’s brisk sales, entering a digestion phase. Order files are into April 11 for most producers, though one is still into April 4. Despite the slowdown, pricing moved up two points. Strong demand for particleboard in the eastern half of the US continued to absorb more volume than mills in that region could produce. MDF trading remained more subdued than particleboard. Buyers found quick shipping volumes available.

For more on RISI, click here.