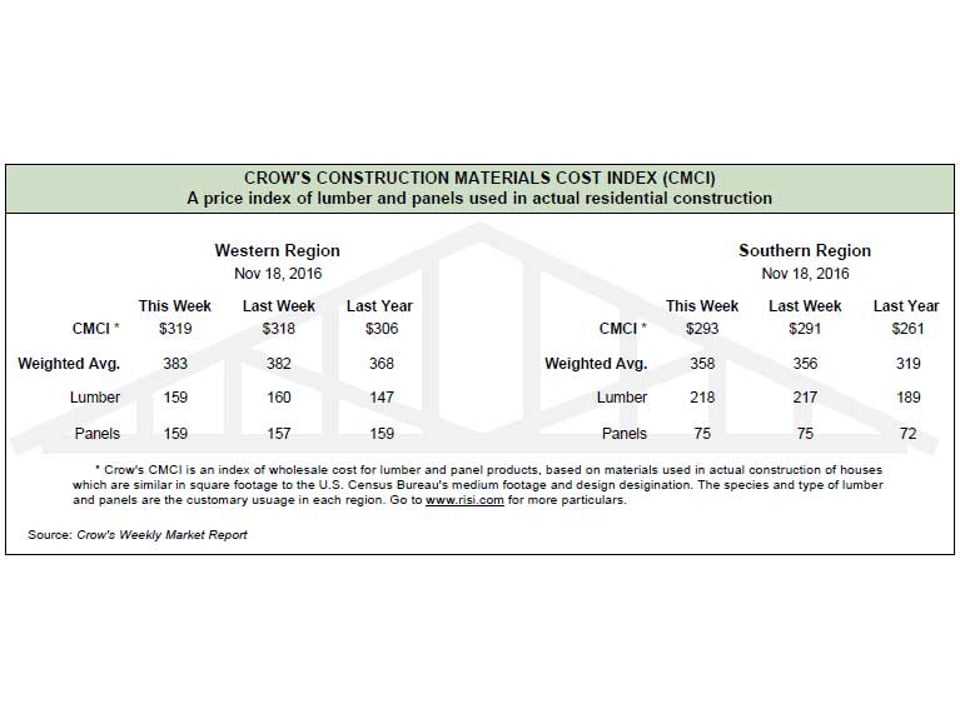

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for March 4, 2016

*Western - regional species perimeter foundation; Southern - regional species slab construction.

Crow's Market Recap -- A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber: Sales activity in the SPF lumber market was light, leaving prices near those levels established previously for most of the week. Demand increased Thursday after futures gained strongly as a result of US/Canadian trade news. Southern Pine producers experienced increased sales compared to the prior few weeks, which varied from mill to mill. In some instances, demand was strong enough to absorb excesses at mills and firm up pricing. Traders saw the Coastal species market as flat to steady, although some producers managed to squeeze slightly higher prices for a few items out of customers. Most pricing was at least firm. Gradual strengthening has been the hallmark of the Inland dimension lumber market over the past 3 weeks. Prices have been moving up very gradually in most items, with some items showing special vigor. Demand for studs subsided, making it harder for producers to rid themselves of any quick shipping volumes without some moderate price adjustments. Thursday’s sharp gain in futures prompted some producers to cease negotiating prices. In both Radiata Pine and Ponderosa Pine, the major questions of supply focus on Mldg&Btr and #2 Shop. Mldg&Btr is scarce enough in Ponderosa to keep prices very firm; it is being driven by increasing log costs for New Zealand producers. Although few changes in Ponderosa Pine board prices were reported, large retailers’ inquiries have clearly changed the tone of the market. Because of the activity in Ponderosa Pine, such species as ESLP and Fir-Larch have rebounded. Eastern White Pine Industrials have also taken on a little vigor. Western Red Cedar mills on both sides of the border continued to elevate prices where it seemed appropriate. Limited availability often spurred the higher prices, with producers pricing defensively in some instances.

Panels: OSB markets slowed to a crawl this week across all US and Canadian markets. Activity went into a digestive phase since buyers filled up on volume over the past three weeks. Pricing is generally seen as toppy, moving sideways or up a couple of dollars from last week. Southern Pine plywood sales remained steady. Most mill order files ended up in the week of March 14, and attempts to leap into the week of March 21 were met with resistance from buyers. Western Fir plywood mills continued to lower prices in search of buyers. Supply continued to outpace demand, as buyers showed limited interest in mill offerings $10 below last week’s levels. Canadian plywood sales activity was moderate for the week, though volumes moved to fill needs. Pricing fell another three points from last Friday’s Crow’s net, as it did last week. A cautious mood is prevalent, driven by fear of further losses. Particleboard remained strong, particularly in the East and South, where mill lead times touched into April. As a result, western particleboard producers reported quoting buyers who usually purchase all of their volumes out of the East. MDF sales activity continued its lackluster pace.

For more on RISI, click here.