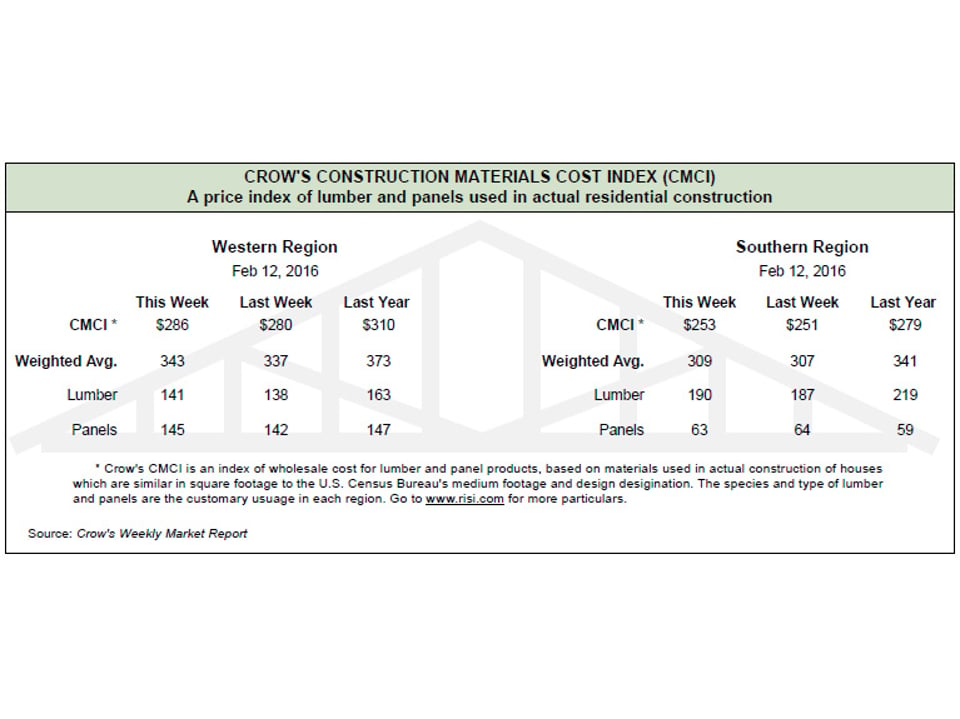

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for Feb. 5, 2015

*Western - regional species perimeter foundation; Southern - regional species slab construction.

Crow's Market Recap -- A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber: Strong SPF sales continued to drive prices higher. Mills and wholesalers reported selling significant volumes. The announcement of a mill closure helped bring some buyers into the market. Futures gains throughout the week instilled some confidence in buyers. Demand for Southern Pine continued to firm or press prices higher. Producers reported solid sales activity, resulting in tighter availability. Treaters continued to replenish. Coastal species mills reported improved sales activity, which helped to firm prices. Dry prices continued to show minimal change, but firmer to higher prices were reported. Green Doug Fir pricing advanced more strongly. The overall tone of the Inland market has been better, including both inquiries and sales. While Fir-Larch prices held very near those of recent price lists, Hem-Fir has weakened further. The focus of the weakness is on the narrows. Stud prices managed to increase in a number of instances and were especially stout in SPF. The announcement of downtime beginning at the end of the week at two eastern SPF stud mills propelled buyers into the market to cover needs. Futures gains throughout the week helped grease the skids. Radiata Pine remains source-based with regard to price. New Zealand Mldg&Btr ranges from $1,375 on the low edge to a high of $1,490, according to reports. No common direction exists in industrial lumber. Ponderosa Pine lumber shows stability in both 5/4 and 6/4 Mldg&Btr, but 5/4 Shop can be secured at a sizable discount. In Ponderosa Pine boards, buyers sense that this could be a time to line up spring volumes. Discounts can be secured on selected #2 Common items, specifically 1x10 and 1x12. Tight knot Western Red Cedar products moved readily, and buyers paid higher prices for some items. Mills reported receiving more money for boards and decking items.

Panels: Despite price drops in most regions (some as deep as $15), OSB activity reportedly had a little more life this week. Order files range anywhere from next week to Feb. 22. Good sales activity and extended ship times kept Southern Pine plywood prices firm and edging higher in some instances. Wholesalers purchased fewer volumes, instead focusing their efforts on selling what they purchased the week prior. Sales activity in Western Fir plywood remained better than it had been throughout most of January. Buyers continued to purchase at a moderately improved rate, which tended to lock market prices for sheathing at the same levels as the prior week or nudge them higher. Canadian plywood activity picked up a bit of steam, as midweek discounting moved some volume and allowed order files to move out. After deals went two to four points off established levels, buyers got in the game, replenishing inventories. Numbers firmed by the end of the week. Particleboard sales continued at a steady pace, keeping mill order files at a comfortable length. MDF sales were described as sporadic and discounts were available.

For more on RISI, click here.