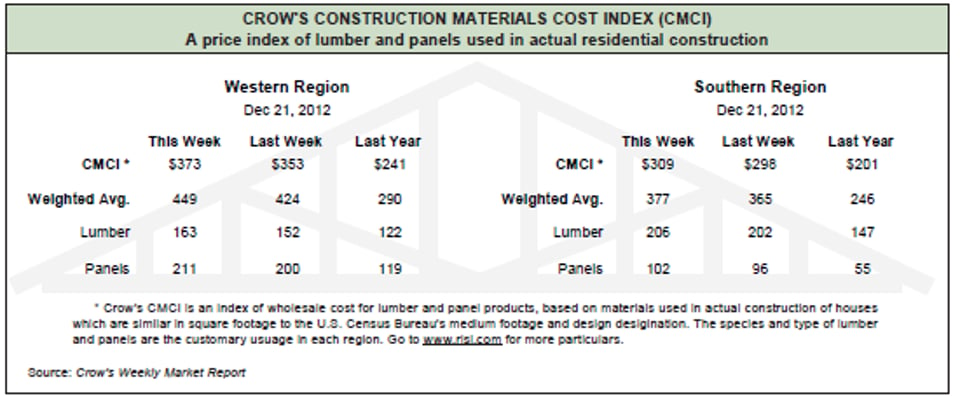

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for Dec. 21, 2012

*Western - regional species perimeter foundation; Southern - regional species slab construction.

Crow's Market Recap -- A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber: The SPF lumber market remained strong, as prices increased and availability remained limited. Sales activity was moderate. Long holiday curtailments and mill order files established well into January kept buyers searching for coverage. A broader range of Southern Pine lumber mills’ customer bases participated early, firming prices and sending them higher as the week progressed. Treaters participated in greater numbers. Mill lead times pushed into January. Buyers continued to purchase strong volumes of Coastal species lumber, again prompting higher prices. Reports regarding the futile efforts of buyers trying to cover jobs with lower priced volumes increased. The Inland species market caught fire late Tuesday and made one more run before the holidays. Traders reported selling anything they owned, as well as experiencing brisk back-to-back business. The emphasis was once again on the narrows, but producers reported wides also sold with ease.Year-end sales activity remained good for Radiata Pine, and producers still had wood available. Blanks remain in short supply, as manufactures continue to make millwork rather than ship lumber. Low grades of Ponderosa Pine Shop continued to be the bright spot in that market. Steady sales of finger joint mouldings kept millwork manufactures coming back to mills for more #3 and P99. Sales volumes remained moderate for Ponderosa Pine Selects and Commons. Activity for narrows in #2&Btr and #3 was better than the wider widths. Light offerings that matched limited demand kept ESLP prices firm. Eastern White Pine prices remained unchanged but firm. The Western Red Cedar market took on a quieter tone. Despite the slower pace, mills continued to push prices where they thought necessary, in part in preparation for the 2013 buying season.

Panels: OSB markets had a surprising run that caught both buyers and sellers off guard. Many had felt the market would be quiet before the holidays. However, a rally beginning Tuesday that moved prices up $30 to $50 put most producers off the market for a time. Southern Pine plywood buyers bought a fair amount of plywood to begin the week, but nothing compared to Thursday, when demand reached a crescendo. Wholesalers continued to purchase volumes for shipment well into the latter half of January. The sales pace in Western Fir plywood was moderate to begin the week but then picked up considerably Thursday. Sheathing prices jumped, as most order files began to touch into the latter half of January. By week’s end, Canadian plywood mill order files had moved out to the week of Feb. 18, and the price of 9.5mm delivered Toronto had increased 9% to end the week at C$447. Particleboard sales meandered through the pre-holiday week at a relatively pedestrian pace. MDF supplies remained tight, and customers remained on allocation.

For more on RISI, click here.