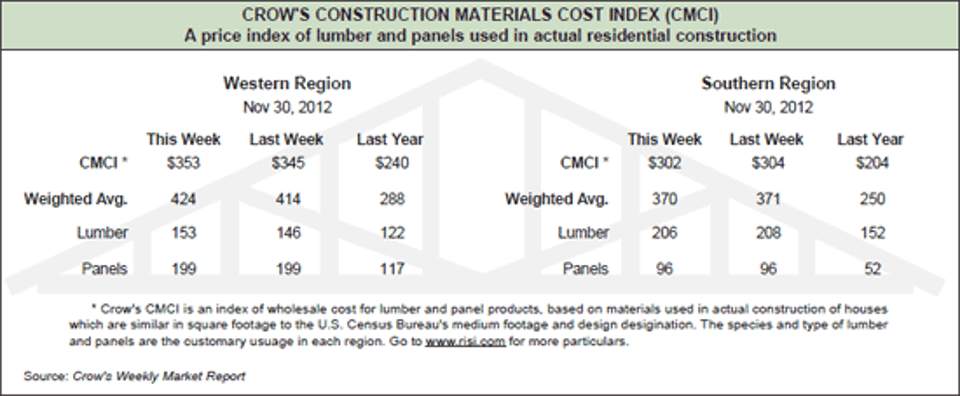

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for Nov. 30, 2012

*Western - regional species perimeter foundation; Southern - regional species slab construction.

Crow's Market Recap -- A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber: Word that China purchased additional volumes out of the western SPF lumber market fueled up-limit moves in futures and a significant buy-in in the cash market beginning Tuesday and lasting through Wednesday. Mill order files extended at least through Dec. 17, if not through the year's end. Southern Pine lumber sales were sluggish, leading to less upward price movement. No urgency among mills to discount beyond a few dollars on a few scattered items left many prices flat. Lumber prices continue to trend higher in the Coastal species market, led by narrow widths which gathered momentum early. The influence of strong futures gains and rising SPF prices were credited for the strong demand. A rally in the lumber futures market added strength to an already improving Inland dimension market. The needs of buyers outweighed the volume of wood being offered, and control of the market remained in the hands of producers. Availability of Radiata Pine tightened and buyers had to work to find coverage in Mldg&Btr. Producers have not adjusted prices, but talk of price increases for 2013 circulated. The Ponderosa Pine industrials market continues to stumble along without clear direction. Prices remained stagnant, as light sales did little to encourage sellers to raise prices. Steady sales of ESLP boards were reported. Eastern White Pine board markets remained stable and prices were firm. Some relief from difficulties securing log supplies was reported. A week of strong bookings helped Western Red Cedar mills fill order files at least through January. Anything sold beyond that date is most often done on a PTS basis.

Panels: An uptick in OSB activity on Tuesday afternoon turned into a rally by Wednesday afternoon. OSB buyers looked for early December wood at the secondary level. Many mills quoted shipment in late December or were off the market entirely. Southern Pine plywood traders often pointed to the calendar when describing market activity. While mills generally held onto the same quoted levels, a few spot deals did take place. Western Fir plywood producers experienced a good week of sales, allowing them to move order files more firmly into the weeks of Dec. 10 and 17. Shipments to a robust Canadian market helped keep supplies in check. The surge in activity in the Canadian Plywood market had quieted somewhat by Friday, but not before mill order files moved out to the week of Jan. 21 or 28, depending on the mill and the item. MDF and particleboard markets continued on a steady, yet seasonal pace. Minor slowing at a few mills was noted in MDF sales. Moulding manufacturers continued to purchase strong MDF volumes.

For more on RISI, click here.