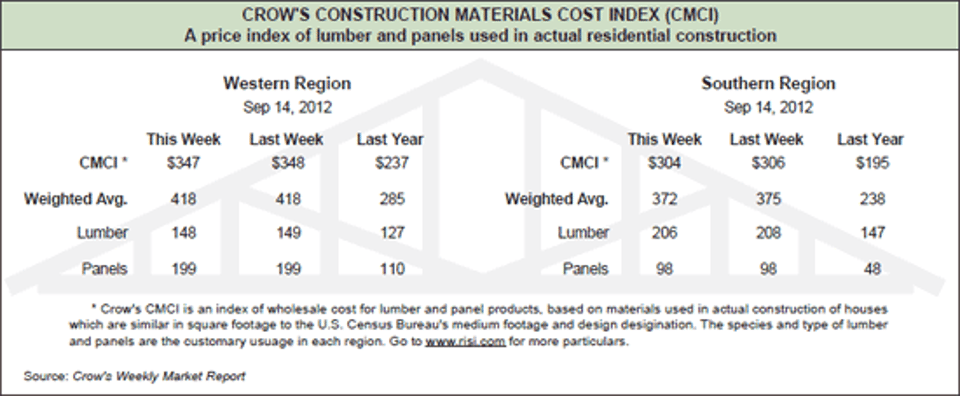

Market Recap: RISI Crow's Construction Materials Cost Index

A price index of lumber and panels used in actual construction for Sept. 14, 2012

*Western - regional species perimeter foundation; Southern - regional species slab construction.

Crow's Market Recap -- A condensed recap of the market conditions for the major North American softwood lumber and panel products as reported in Crow's Weekly Market Report.

Lumber: SPF lumber producers pursued orders by lowering prices, and achieved varying amounts of success, depending on the depth of discounts. Mills in the East seemed more aggressive with price cuts. Some ex-pitting was done. Modest demand in the Southern Pine lumber market for wide widths continued to place downward pressure on those items, while 2x4 #2 held up across all zones. Some treaters, approaching their year-ends, scaled back purchases because of inventory concerns. Sales of #2&Btr items in the Coastal species lumber market were not made without some kind of a discount. Green Doug Fir producers were more aggressive with discounts than dry producers. Buyers looked for "ultra-specific" tallies to keep inventories lean. Inland species lumber buyers were on a bargain hunt, and producers found themselves having to discount in order to write business. Limited availability of Radiata Pine Mldg&Btr kept prices firm, even though demand seems to have waned. Shop grades were unavailable, as producers supplied off-shore markets or used it internally. Buyers of Ponderosa Pine shop lumber remained on the sidelines, making purchases on only those items they had to have. The market for Ponderosa Pine boards improved, as producers cleaned up excess items and firmed up prices on some. The Eastern White Pine market remained on the quiet side. Moderate sales of Idaho White Pine were reported, and some prices adjusted down slightly Western Red Cedar producers sold moderate volumes at a steady pace, reflecting much the same tone as in past weeks. Mills tinkered with prices very little, seeing no need to either create concern among buyers or "squeeze another nickel out of them."

Panels: Mill sales of OSB were on the quiet side, as buyers turned to wholesalers and stocking distributers to cover their needs. Western mill order files were into the first two weeks of October, with only a few offerings for shipment the week of September 24. Rated sheathing order files thinned, forcing Southern Pine plywood producers to discount in some instances. Yards filled inventory holes while wholesalers stood on the sidelines. Sales of Western Fir plywood depended on how deep a mill wanted to discount to move volumes. Most sheathing order files extended out into the week of September 24, but it sometimes took discounts to get there. Major Canadian plywood producers, having order files into early October, held prices firm and saw little incentive to discount their cash wood. Some peripheral producers with shorter order files were more open to counters and wrote some business at a discount to published levels. Buyers did not purchase enough particleboard volumes to give producers any cushion. Individual mills continued to raise MDF prices on some customers.

For more on RISI, click here.