Attitudinal analysis in the DIY market

Data from the Home Improvement Research Institute, in association with Naxion Research and Consulting, carefully examines the differences between consumers designated as “High DIY” and those as “Low DIY.”

How were the groups defined? Largely by attitude. HIRI’s Product Purchase and Project Activity DIY Comparison report used scores from seven attitudinal measures to divide the consumer base. For example, the more one agrees with “I enjoy doing yard work,” and the less one agrees with “I don’t have time to do any do-it-yourself projects,” the more likely one is to be classified in the “High DIY” group.

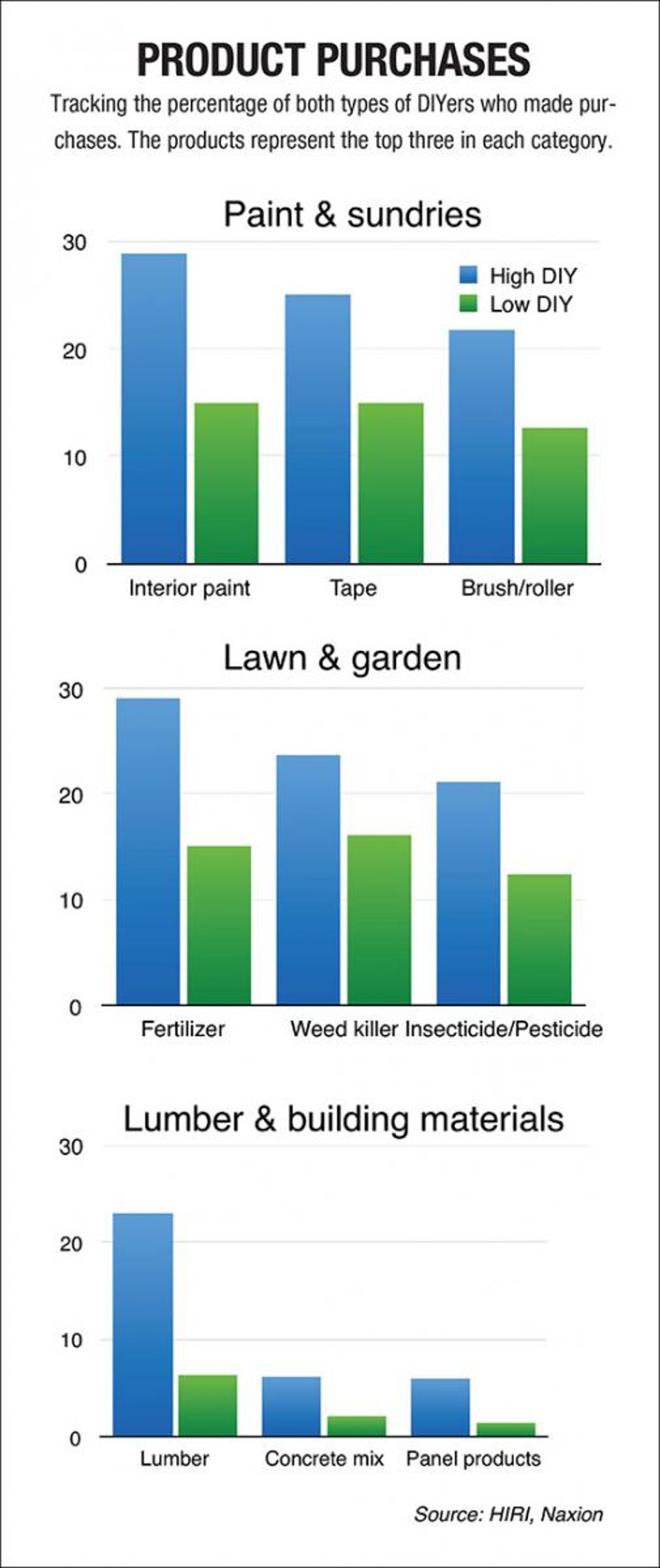

Once divided, the research shows that High DIYers were more active in nearly all projects. And the product categories in which High DIYers outspent Low DIYers by the largest margin were paint and sundries, lumber and building materials, and lawn and garden.

In categories such as hardware, plumbing, and electrical and lighting, High DIYers also spent more, but the difference was less pronounced.

The research also showed that more and more people think that they do not have the time for DIY projects, a sentiment which has been increasing since 2006.

For more information, visit HIRI.org.