The labor market slowed in September

The Conference Board Employment Trends Index (ETI) decreased in September to 108.48, from an upwardly revised 109.54 in August. The Employment Trends Index is a composite index for payroll employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

"The ETI has been on an extended downtrend that mirrored the decline in job vacancies over the past two years, yet the overall employment picture has remained strong through much of that time," said Mitchell Barnes, an economist at The Conference Board. "And while hiring has slowed in recent months from its former rapid pace, last week's Employment Report showing outsized gains in September should alleviate some concerns—right at the time the Fed has started its rate-cutting cycle. Despite falling steadily from its peak, the ETI remains around 2018-19 levels."

The Employment Trends Index aggregates eight leading indicators of employment. Aggregating individual indicators into a composite index filters out "noise" to show underlying trends more clearly, according to The Conference Board.

The eight leading indicators of employment aggregated into the Employment Trends Index include:

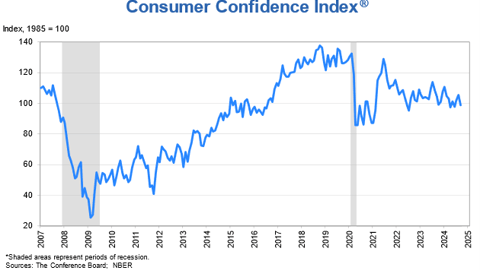

- Percentage of respondents who say they find "Jobs Hard to Get" (culled from The Conference Board Consumer Confidence Survey)

- Initial claims for unemployment insurance (U.S. Department of Labor)

- Percentage of firms with positions not able to fill right now (National Federation of Independent Business Research Foundation)

- Number of employees hired by the temporary-help industry (U.S. Bureau of Labor Statistics)

- Ratio of involuntarily part-time to all part-time workers (BLS)

- Job openings (BLS)

- Industrial production (Federal Reserve Board)

- Real manufacturing and trade sales (U.S. Bureau of Economic Analysis)

While topline payrolls gained 253,000 and the unemployment rate fell, the ETI components from the September jobs report—employment in temporary help services and share of involuntary part-time workers—were both largely flat. Job openings (an ETI component) showed an unexpected jump in August data, but their downward trend has contributed to ETI's decline since openings peaked in 2022.

The labor market shows no signs of rapid weakening as initial claims for unemployment insurance (an ETI component) have fallen to a weekly average of 224,000 in September—down 6 percent from June. Industrial production and Real manufacturing and trade sales (both ETI components) are each up by roughly 2 percent on the year and had strong readings in their recent releases.

"With many companies fully restaffed to prior levels, jobseekers have begun experiencing challenges entering the market at this stage," added Barnes. The share of respondents who report 'jobs are hard to get'—an ETI component from the Consumer Confidence Survey—rose for the fifth consecutive month to 18.3 percent in September 2024. While concerning, this follows from a decline in job openings and tempered labor demand, which Fed policymakers were monitoring. The current level of job-finding difficulty is on par with survey responses in 2017—still not a sign of deterioration, especially as much of the input data for September reflects the period prior to the Fed interest rate cut."